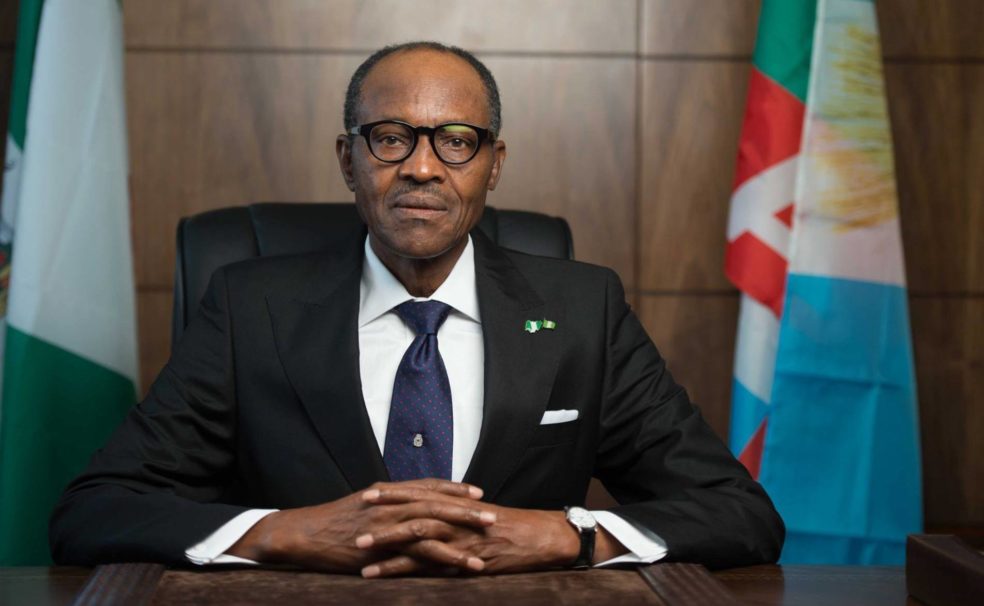

As the President Muhammadu Buhari-led administration strives to rescue the nation’s economy with a focus on diversification, experts in the energy sector have continue to emphasise the need to deploy Liquefied Natural Gas (LNG) as a key component to hastening the initiative.

There is no gainsaying that a good number of experts in the oil & gas industry perceived that the nation could have been immune from the plummeting crude oil business if strategic focus has been channelled to the natural gas subsector.

Others have equally expressed confidence in the ability of Nigeria to even earn more from the full utilisation of gas resources than what it is currently realises from crude oil exports, and to further drive this home, the 2016 edition of the Oil & Gas Review, a report detailing operators’ view of the industry conducted by PricewaterHouseCooper (PwC) forewarn about the inherent dangers facing the future of the petroleum industry.

Part of the report reads, “It is clear that the momentum to replace fossil fuels with cleaner energy sources, sooner rather than later, is gathering pace. Consequently, oil & gas companies would be well-served to review their long-term strategies, and recognise the possibility that oil could suffer a similar fate to coal in the coming decades.”

Addressing the challenges faced by operators in the industry, the report reads, “With a sustained downturn in the oil price, the industry continues to respond by reducing cost, postponing or cancelling projects and exploring ways to reinvent itself.”

Meanwhile, the International Energy Agency (IEA) said that natural gas is set to become the world’s leading fossil fuel by 2030 and is expected to replace oil by 2014. Interestingly, data obtained from the Department of Petroleum Resources (DPR) shows that Nigeria is endowed with 188 trillion standard cubic feet (scf) of gas resources, making it the 8th largest country in terms of gas reserves and 13th largest producer of the commodity globally.

Boosting the domestic economy

Bearing in mind the critical role power generation plays in ensuring the growth of any economy, it becomes paramount that if there is one sector that this administration must address to bring about an economic revival, it is obviously the power sector. The continued cry from the various chambers of commerce across the country on the challenges their members are facing as it concerns the negative impact of the absence of electricity should give the government concern. Better still, the PwC report revealed that Nigeria has about 13 giga watt (GW) of electricity generating capacity, a transmission capacity of 5GW and distribution that hovers between 3.5GW and 4.2GW.

Currently, natural gas accounts for more than 80 per cent of Nigeria’s fuel needs. About 30 per cent increase in available generation is possible if the gas constraints are resolved. The report noted that gas consumption, rather than reserve base, is fundamental to economic growth and development. Therefore, domestic use should be the priority whilst the LNG and export ambitions should be limited. Currently, Nigeria consumes 15 per cent of its gas production domestically, exports one third whilst almost a half of the total production is wasted due to flaring.

Meanwhile, the electricity sector provides the natural edge for the demand-supply imbalance. It is suggested that distribution companies (DISCOs) should deploy a new strategy which enables them to site embedded generation in their areas of operation.

Policy redirection

The PwC report stated that appropriate and prompt implementation of swop arrangements, reinforced commercial framework, aggressive pursuit of the Gas Master Plan, and government-backed instruments and regulation will culminate in a more robust sector. According to the report, the Petroleum Industry Bill (PIB) is still a contentious document because the promoters of the bill want it to tackle all the inconsistencies in the oil and gas sector.

To advance the sector for the benefit of the local economy it was advised that bureaucracy and troublesome business processes must be jettisoned and investor-friendly policies and incentives, together with appropriate transport laws and competent regulations created and/or enforced so as to encourage entrants to invest in the power sector and to prove that the creation of an enabling environment is not theory. In addition, emphasis was laid on the need for a continuity machinery and adherence to contracts, stressing that it cannot be dispensed with. Policy inconsistency, according to the report, must be eschewed so as to pave way for clarity and certainty.

Growing the industry

The key issue of vandalism of gas pipelines and transmission infrastructure, which are major pitfalls in the power industry, were identified as areas that require urgent attention in order to make progress. Consequently, the speedy execution and delivery of a number of on-going infrastructure projects is inevitable. In addition, it was highlighted that the supply, processing, transportation and distribution challenges in the gas sector need to be handled for optimal performance.

On financing, the report stressed that private sector financing will provide the infrastructure required for the transformation of the transmission subsector. They therefore encouraged the emergence of mini and micro grids co-existing alongside the large grids.

Gas Pricing

The report did suggest that gas prices should not be subjected to a subsidy, thereby politicising it. Rather the commodity’s price should be determined by global trends and market forces.

While commending some policies and regulations which have resulted in the resolution of a number of challenges in the sector, the report extolled the ingenuity of the forerunners in the generation. According to it, their efforts have resulted in considerable independence in that subsector.

In what appears to be a confirmation of the key issue DISCO operators have blamed their poor performance on low income generation. The report reads that more than 50 per cent of distributed power is consumed free-of-charge. In other words, less than half of customers pay for electricity usage. It therefore advised that power must be realistically priced because it is only through cost-reflective tariffs that the cost of generation will be recovered and investments made in new large-scale generation and transmission projects.

The PwC crew argues that distribution and transmission capacities must significantly increase to warrant further gas supplies, stating that the DISCOs, particularly, need to improve their own networks in preparation for the probable resolution of the bureaucracy in generation.

“If that bureaucracy is broken today, the DISCOs cannot take up all the available power,” the report stated.

Megacities

Population growth, compounded by the emergence of megacities, the report noted will have a profound effect on the country’s power sector. It therefore stressed that the scale of investments needed in the sector is illustrated by the rule of the thumb for industrialised nations which stipulates that approximately every one million people require 1,000 mega watts of electricity

Source: www.leadership.ng