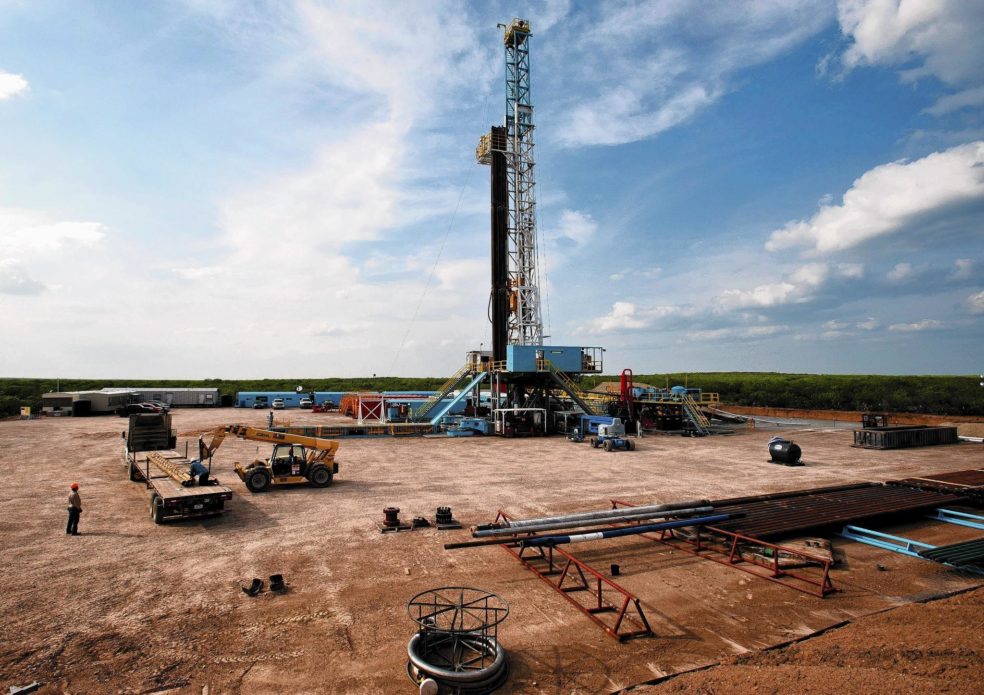

U.S. oil drillers added rigs for the sixth-straight week, marking the longest period of expansion in a year, as the shale patch revives from the worst downturn in a generation.

Rigs targeting crude in the U.S. rose by 7 to 381 in the past week, Baker Hughes Inc. said on its website Friday. Explorers have now added 51 rigs since June 24, expanding activity in nine of the past 10 weeks. The rise was prompted by a rebound in prices that peaked in June before falling off again.

“We’ve seen a month and a half of rising rig counts, but we haven’t seen the impact of the lower prices of a few days ago, and we won’t see that for a couple of months,” said James Williams, president of WTRG Economics in London, Ark. “This rig count is really based on prices a month or two ago because that’s when the decisions get made.”

A rebound from a 12-year low in February prompted U.S. oil drillers to begin bringing back parked rigs, after idling more than 1,000 oil rigs since the start of last year. The last time explorers added rigs for six weeks in a row was July and August 2015.

The longterm decline in rigs has gradually led to slowing production. U.S. crude output decreased by 55,000 bpd to 8.46 MMbpd in the week ended July 29, the EIA reported Wednesday. Stockpiles at Cushing, Okla., the delivery point for West Texas Intermediate crude and the nation’s biggest storage hub, fell the most in six weeks.

“Global fundamentals are balanced,” Mike Wittner, head of oil market research at Societe Generale SA in New York, said Thursday. “We’re not oversupplied the way we were in the first quarter.”

Baker Hughes said natural gas rigs were trimmed by 5 to 81 this week, while miscellaneous rigs were reduced by 1 to 2, bringing the total for oil and gas up by 1 to 464.

West Texas Intermediate for September delivery was down 42 cents to $41.51 at 1:35 p.m. on the New York Mercantile Exchange. The contract had touched $41.06 earlier in the day, paring the biggest two-day gain in a month after slipping into a bear market earlier this week.

Source: http://www.worldoil.com